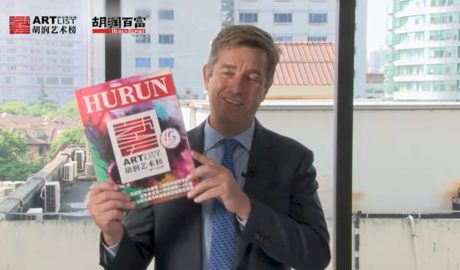

Number of US billionaires increased more than those in China – Rupert Hoogewerf

The number of billionaires has increased more in the US compared to China for the first time in ten years, according to the latest 14th annual Hurun Global Rich List, according to Barrons. “It’s been a tough year for luxury, telecommunications, and real estate in China”, writes Rupert Hoogewerf, chairman and chief researcher of the Hurun Report.Read More →