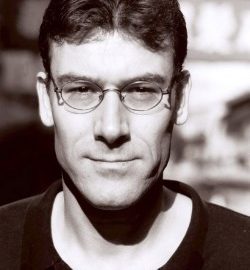

The End of Cheap China hits US book shelves – Shaun Rein

Shaun Rein’s long-awaited book on The End of Cheap China: Economic and Cultural Trends that will Disrupt the World has reached the shelves of US book stores. Key lessons on change in China.Read More →