How is the EU-China relationship moving on – Shaun Rein

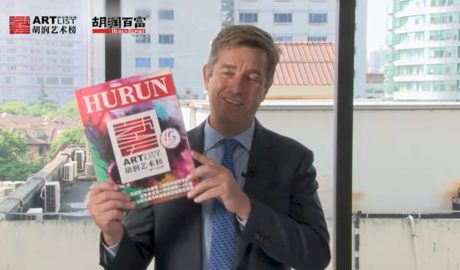

Business analyst Shaun Rein, author of The Split: Finding the Opportunities in China’s Economy in the New World Order, dives into the future of EU-China relations, as Trump is getting settle for his second term as US president. He discusses the currently hostile relationship between some of the EU leaders and how the European continent can move ahead with a better relationship with China, more independent from the United States, he tells Volker Friedrich.Read More →