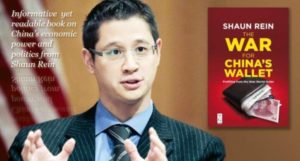

Chinese insurance and investment conglomerate Fosun International snapped up Brazilian asset manager Guide Investimentos for US$52 million on Tuesday, reversing a trend of disinvestment after the central government came after conglomerates with excessive outbound investments. Shaun Rein, author of The War for China’s Wallet: Profiting from the New World Order, explains in the South China Morning Post why Brazil is such a popular destination.

The South China Morning Post:

“Fosun is regaining pace – it seems like a signal that political pressure is easing for the company,” said Shaun Rein, the managing director of Shanghai-based market intelligence company China Market Research and author of The War for China’s Wallet: Profiting from the New World Order.

“Brazil is attractive given its market size and population. The asset prices are also attractive there, compared with those in Southeast Asia, which gained a lot of investment from China last year,” he said.

Tuesday’s deal is the second acquisition of a Brazilian financial institution by Fosun. In July 2016, the group bought Brazilian fund manager Rio Bravo Investimentos, its first acquisition in Latin America.

More at the South China Morning Post.

Shaun Rein is a speaker at the China Speakers Bureau. Do you need him at your meeting or conference? Do get in touch or fill in our speakers’ request form.

Are you looking for more experts on China’s outbound investments at the China Speakers Bureau? Do check out this list.